When evaluating the value of active management versus indexing, the S&P Indices Versus Active (SPIVA) reports have been widely referenced. These reports compare the performance of actively managed funds to their respective S&P index benchmarks.

The conclusion has been consistent over time: historically, actively managed funds have a tendency to underperform their benchmarks over both the short- and long-term. With some exceptions, this has tended to hold true across countries and regions.

Even when a majority of actively managed funds in a category have outperformed their benchmark over a single period, they have usually failed to outperform over multiple periods.1

The fixed income exception

While the above tends to be true for equities, results are a bit more favourable for actively managed fixed income funds over the long run.

First, indexing in fixed income is arguably more complex than indexing in equities. For instance, fixed income indexes will typically include many more securities than an equity index. Many of these securities are illiquid, because they are purchased by investors who hold them to maturity. Meanwhile, an aggregate fixed income index will be highly exposed to government bonds, which usually have the lowest yields and the highest duration at any given maturity. (Spoiler alert: this opens up a systematic opportunity for active managers).

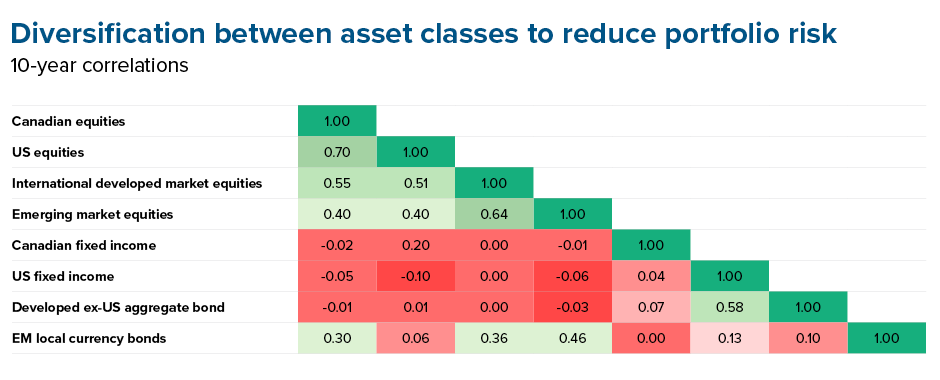

Second, the role of fixed income in a portfolio is not strictly about performance. There are several other potential benefits to holding fixed income, such as potentially increasing risk-adjusted returns, generating income, preserving capital and equity diversification.

Source: Morningstar Direct as of September 30, 2023. All returns in CAD. Exposures are represented by the following indices: Canadian Equities: Solactive Canada Broad Market TR CAD, US Equities: Solactive US Large Cap TR CAD, International Developed Market Equities: Solactive GBS DM ex NA L&M C TR CAD, Canadian Fixed Income: FTSE Canada Universe Bond, US Fixed Income: BBgBarc US Agg Float Adj TR Hedged CAD, Developed ex-US Aggregate Bond: BBgBarc Gbl Agg xUSD 10& IC TR Hdg USD, EM local currency bonds: Bloomberg EM LC Govt TR USD.

Source: Morningstar Direct as of September 30, 2023. All returns in CAD. Exposures are represented by the following indices: Canadian Equities: Solactive Canada Broad Market TR CAD, US Equities: Solactive US Large Cap TR CAD, International Developed Market Equities: Solactive GBS DM ex NA L&M C TR CAD, Canadian Fixed Income: FTSE Canada Universe Bond, US Fixed Income: BBgBarc US Agg Float Adj TR Hedged CAD, Developed ex-US Aggregate Bond: BBgBarc Gbl Agg xUSD 10& IC TR Hdg USD, EM local currency bonds: Bloomberg EM LC Govt TR USD.

Over time, many investors’ risk profiles become more conservative, with their risk tolerance and/or time horizon decreasing. As a result, their portfolio asset mix may shift toward more fixed income, because it’s seen as more ‘safe’ and less volatile asset class, with a more predictable return outcome.

Looking at the reasons why and how fixed income is generally included in portfolio construction, the value of active management in this asset class must be measured accordingly: when building portfolios under risk constraints, a risk budget is set in accordance with the investor risk tolerance in different hypothetical scenarios. The resulting portfolio will aim to maximize expected returns within the risk budget.

Why is fixed income different?

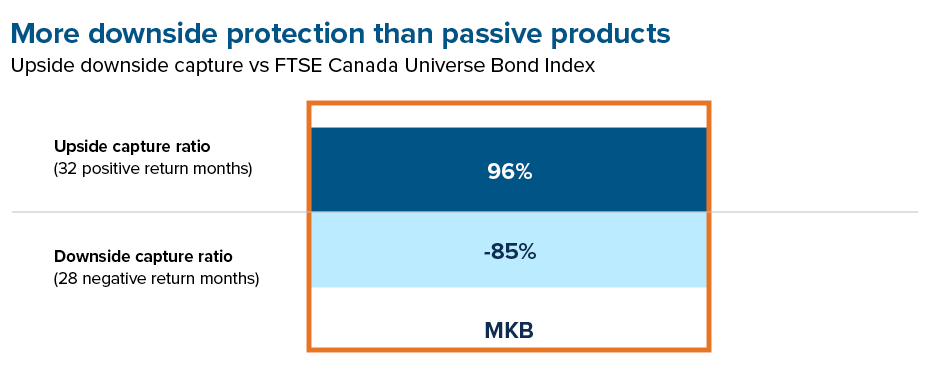

An actively managed fixed income strategy might choose to try and outperform its benchmark by adopting an approach that does not maximize its upside capture, but rather minimize downside capture (versus the index). By focusing on risk management, capital preservation and downside protection while capturing the index beta on the upside, if successful, the strategy will eventually outperform its benchmark with lower downside capture – that is to say, better returns with less risk, and a behaviour resembling the index.

For example, below we show the upside and downside capture rate of Mackenzie Core Plus Canadian Fixed Income ETF (MKB), an actively managed Canadian fixed income ETF.

Source: Mackenzie Investments, Morningstar Direct for the period from April 1, 2019 to March 31, 2024. Average upside and downside capture ratios calculated on monthly returns vs. the FTSE Canada Universe Bond Index.

Source: Mackenzie Investments, Morningstar Direct for the period from April 1, 2019 to March 31, 2024. Average upside and downside capture ratios calculated on monthly returns vs. the FTSE Canada Universe Bond Index.

As always, outcomes will depend on whether investors stay the course and remain consistent in monitoring the strategy based on the rationale for choosing it in the first place. Investors tend to overestimate their risk tolerance, especially when the markets and their investments are rising in value, and forget the role fixed income plays in their portfolio.

Fixed income investing with active ETFs

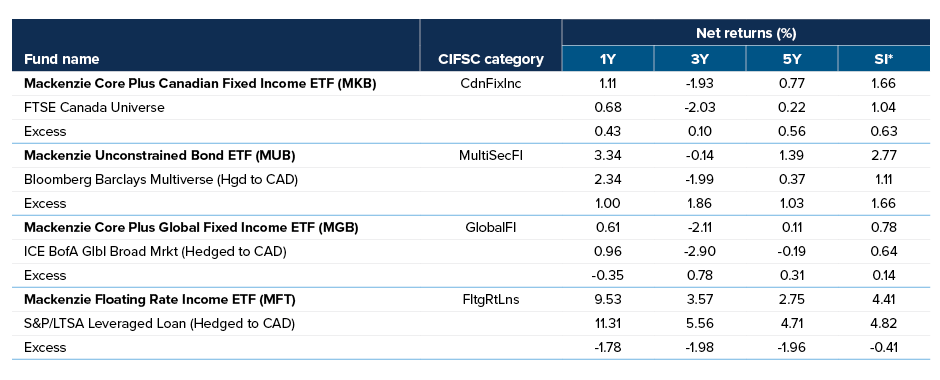

Mackenzie Investments started its journey as an ETF provider with the launch of innovative actively managed fixed income ETFs in April 2016.

On April 19, 2024, MKB, MUB, MGB and MFT reached their eighth year since inception, standing strong at 73% asset weighted outperformance versus their respective benchmarks2. This period included several major events, including the worst year on record for fixed income performance.

That’s much better than the single digit SPIVA observations for the US General Government Fixed Income category over five years.3

The below table shows performance and excess returns versus respective benchmarks, highlighting the value of fixed income active management.

Source: Mackenzie Investments, performance as of April 12, 2024. Includes annualized performance over 1Y. *Since inception: April 19, 2016.

Source: Mackenzie Investments, performance as of April 12, 2024. Includes annualized performance over 1Y. *Since inception: April 19, 2016.

For more information about Mackenzie active ETFs, explore our product list.

______________________________

1 SPIVA | Indices S&P Dow Jones (spglobal.com)

2 Source : Mackenzie Investments, April 22, 2024.

3 SPIVA | Indices S&P Dow Jones (spglobal.com)

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 22, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.