Written by the Mackenzie Fixed Income Team

Key Highlights

- The unpredictability of U.S. tariff policies continues to shape market behavior. After broad tariff announcements, fixed income markets shifted to a cautious approach, with lower treasury yields and wider credit spreads signaling worries about a possible trade conflict.

- While tariffs might push prices up, Fed Chair Powell’s description of tariff-driven inflation as “temporary” argues that a single tariff hike is unlikely to lead to persistent inflation that would prompt Federal Reserve intervention, tempering expectations for immediate rate increases.

- Market volatility remains high, with the VIX reaching levels reminiscent of the global financial crisis, driven by uncertainty over tariffs and their economic impact. Safe-haven sovereign yields have also risen recently.

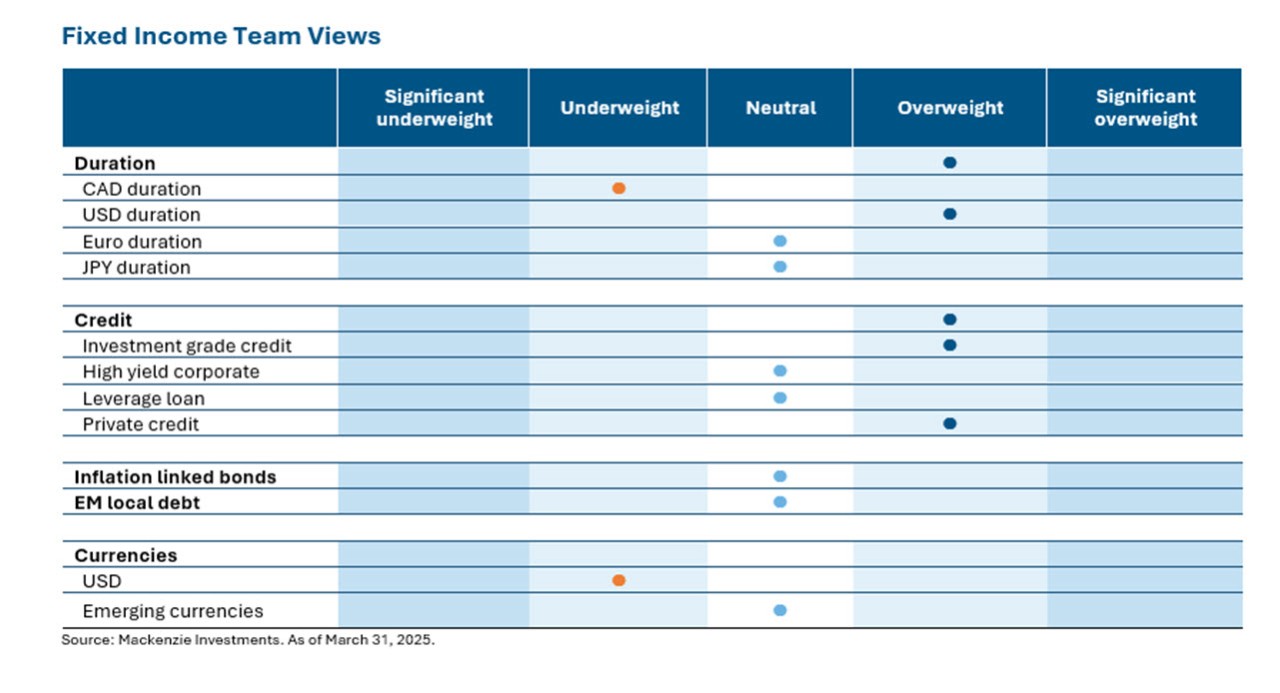

- The portfolio strategy focuses on extending duration, overweighting U.S. fixed income assets (especially nominal treasury bonds), and reducing exposure to tariff-sensitive sectors and inflation-linked bonds. It also emphasizes higher-rated credits to manage credit risk amid uncertainty.

Fixed Income Market Update

Uncertainty continues to be the word that dominates the narrative around tariffs. Although ‘Liberation Day’ provided insight, it remains to be seen the distance the U.S. administration is willing to go and the impact they are willing to tolerate to accomplish their agenda. In the days following the announcement of sweeping tariffs, fixed income markets responded with a risk off tone as yields on risk free treasury bonds decreased across the curve and the market priced in four 25bp rate cuts for the remainder of 2025. G10 Government bonds have done particularly well given the negative move in equities and helping to restore confidence in the low correlation and diversification benefits of bonds in a portfolio. Credit spreads – both investment grade and high yield – have widened from recent tights as credit markets negatively react to the possibility of a protracted trade war. As uncertainty remains, volatility will persist. That said, at time of writing safe haven sovereign yields moved higher.

The idea that tariffs present the potential to be inflationary has merit. The challenge here for market participants is gauging the impact or the transmission effect as tariffs make their way through the economy. Against this backdrop we have seen volatility continue to dominate the narrative as the markets fear gauge, the Cboe Volatility Index or VIX, has reached levels reminiscent of the global financial crisis.

On the other hand, an alternative argument could be made that a one time increase in tariffs would not result in a sustained increase in prices that would translate into a move that would warrant action from the Fed. This has essentially been the view that we believe has a higher probability of materializing. If tariffs were increasing quarter over quarter, then we believe a sustained increased in inflation would be more likely. More recently, Fed Chair Jerome Powel used the word ‘transitory’ to describe the inflation stemming from recent tariffs giving credence to the view that increases in interest rates may not be necessary in the short term.

Positioning

In the current fixed income landscape, our strategy is centered on a deliberate extension of portfolio duration, reflecting a nuanced regional allocation. We are overweight in U.S. fixed income assets, where opportunities appear more favorable, while maintaining an underweight position in Canada and a neutral stance in Europe. This positioning allows us to balance yield potential with regional risk dynamics.

Simultaneously, we are prioritizing a reduction in overall credit risk with greater focus toward increasing exposure to higher-rated credits in an environment where credit quality is paramount. In parallel, we have strategically reduced exposure to tariff-sensitive sectors such as consumer discretionary, industrials, and automotive, acknowledging the potential headwinds from trade policy uncertainties. We are closely evaluating the timing and scale of re-risking into credit as valuations adjust. That will be a key strategic focus in the coming weeks.

Duration has been increased, primarily through an overweight in US nominal bonds. This has added resilience as rates have rallied. We have further eliminated our exposure to inflation-linked bonds to increase the Fund’s interest rate sensitivity. Canadian duration remains low, reflecting our view that US and Canadian curves are likely to compress further.

Within our Canadian strategies, we are overweight duration primarily through exposure in US nominal treasury bonds, reflecting our view that US and Canadian curves are likely to compress further. This has added resilience as rates have rallied. We have further eliminated our exposure to inflation-linked bonds to increase the Fund’s interest rate sensitivity. More recently, provincial bonds have demonstrated resilience with buying appetite being supportive of the market. Longer term, long provincials could face challenges as the prospect of increased supply beings to materialize and therefore we would look to revisit this position.

In our global mandates Canadian credit exposure has also been significantly reduced. The economic backdrop remains weak, and we have actively de-risked by trimming exposures in Canadian energy, retail, and even our long-held subordinated bank debt. What remains is concentrated in more defensive sectors: pipelines, telecoms, utilities, and core senior bank debt. In the US, we pre-emptively lowered exposure to sectors heavily tied to government spending, including healthcare, pharma, and technology. With rising political focus on spending efficiency and oversight, we expect continued pressure in these areas. These adjustments aim to insulate the portfolio from volatility tied to geopolitical developments. Meanwhile, we maintain a neutral position in leveraged loans, reflecting a cautious yet balanced approach to this segment of the market.

Credit Market Performance

Our active overweight investment grade corporate credit exposure has held up well allowing for higher income in addition to duration gains. In expectations of Tariff related volatility, we have positioned the portfolio with lower than benchmark exposures to sectors at highest risk (e.g. consumer discretionary, industrials, automotive) and see room for credit spreads to widen. We have also reduced our exposure in Canada to the energy and retail sectors.

The high yield bond & leverage loan exposures are highly correlated to growth prospects. The bonds appreciate in times of economic expansion, in a parallel fashion expectations of economic contraction can lead to wider spreads as we witness in today’s environment. That said, the recessionary probabilities have since risen materially but not to 100%. If we do see further upward revisions, the spread could further widen to reflect the pain in the economy. The lower rated issuers who are typically highly leverage and more sensitive economically are down materially in this cycle. High-yield bonds are down -2.51% in the first few days of April with CCCs (-4.3%) underperforming Bs (-2.6%) and BBs (-1.9%). As well, sector dispersion has risen with Consumer Products (-4.3%), Energy (-3.6%), and Retail (-3.6%) lagging month to date. The HY index is providing a -1.5% loss YTD with BBs (-0.4%) outperforming Single Bs (-1.9%) and CCCs (-4.8%) The yield is higher by nearly 140 bp to 8.60% and spreads wider by 160 bp to 470 bp.

Leveraged loans are down -1.7% in the first few days of April with BB, B1, B2, B3, and CCC-rated loans returning -1.4%, -2.1%, -1.9%, -2.4%, and -3.5%, respectively. As well, sector dispersion has risen with Retail (-3.9%), Consumer Products (-3.2%), and Media (-2.9%) lagging month to date. At the time of writing the Leverage Loan index, which is absent of duration risk, is lower by -1.5% YTD as the lower secondary prices have more than offset the gains from coupon clipping.

Our active overweight exposure to high quality investment grade bonds along with defensive sector positioning have helped endure the Funds to better manager the downturn with adequate liquidity. Our existing tilt toward non-cyclicals and under weight to the most economically sensitive sectors: autos, consumer discretionary, and industrials, particularly those more directly exposed to trade and tariff impacts has served us well.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of March 31, 2025, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.